As a landlord, you do need to consider the issues of an empty property. Specifically, we’re talking about paying council tax and the recent surcharge that is aimed at landlords with empty properties.

Thankfully, there is a way to avoid paying tax while a property is empty. But first, let’s consider what tax you could be expected to pay for your empty property.

What Are You Expected To Pay?

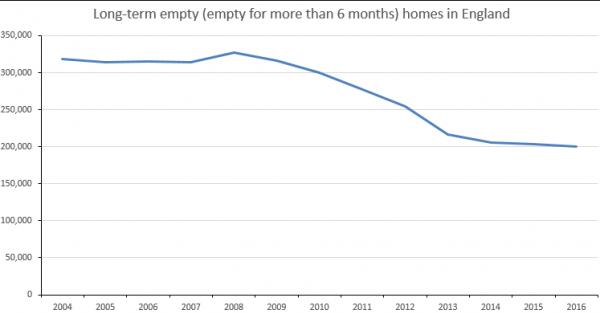

With 2017, it was reported that there were at least 200,000 empty properties across the UK.

These properties are worth £40 billion in total. That same year, Philip Hammond announced plans to get these properties filled, encouraging owners to either let or sell.

The 100% council tax premium for empty properties is a massive issue for landlords and property owners.

The premium means that councils and local authority can charge double what they could previously for empty homes and houses.

As such, landlords with empty properties will be paying double what they should be in council tax.

But it’s not just landlords that are feeling the squeeze. Many people have empty properties that are largely empty.

How can these individuals avoid paying a massive council tax bill each month?

Let It Out

If you haven’t already considered this, you might want to think about letting out the property.

With management companies, this can be a completely off hand experience where it doesn’t eat away into your private time or cause you any stress at all.

You’ll also be able to avoid some of the most expensive tax issues and ensure that you are getting an extra income as well.

Know The Exceptions

You might find that local authorities are keen to get you to pay even if your property is not technically empty.

First, you need to be aware of the definition of an empty property. You might have left your home ‘substantially furnished.’

If that’s the case, then it is not empty, and therefore you are not chained into paying the surcharge.

As well as this, the property may have been empty for less than two years, and if that’s the case, it is not considered empty at all.

This is great news for landlords letting out to tenants and leaving them empty over the summer months.

There are various other exemptions to be aware of as well. For instance, the original occupier of the property could be in prison, in the armed forces or living in a care home.

In any of these situations, council tax does not need to be paid.

Getting Discounts

Council tax is controlled by the local council tax office. As such, it is worth contacting them to find out whether you are liable for council tax for your empty property.

You might find that you are entitled to some sort of discount depending on your situation. While this won’t wipe out the council tax completely, it will make it a lot easier to pay.

Indeed, it is possible for councils to give property owners a discount that allows them to pay absolutely nothing.

This is determined on a case by case basis.

We hope you find this information useful when looking for ways to avoid council tax on an empty property.